refinance transfer taxes virginia

New York 2000. 13th Sep 2010 0328 am.

What Should You Expect When Closing On A Home Real Estate Tips Home Buying Process Remax Real Estate

For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes.

. Deed Transfer Tax 11 of the salespurchase price up to 400000 145 of the sales price over 400000. Virginia Code 581-802 imposes an additional grantors tax of 50 on every 500 or fraction thereof exclusive of any lien or encumbrance remaining thereon at the time of the sale on the greater of actual value of the property conveyed or the consideration of the sale. Last month on the 3rd the average rate on a 30-year fixed.

The Commonwealth of Virginia levies a tax of 25 cents on every 100 on the amount refinanced Virginia Code 581-803 A. This change is applicable to deeds of trust recorded on and after July 1 so it should impact a good faith estimate any bank is issuing presently that wont close before July 1. County recordation taxes Counties in Virginia are allowed to collect one-third of the amount of the state recordation tax which would be 833 cents on every 100 Virginia Code 581-803 A.

In the event of an. Currently the average 10-year fixed-rate refinance is 471. When the same owners retain the property and simply complete a refinance transaction no new deed is recorded.

4 hours ago30-year fixed refinance rates are averaging 539. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST.

The home seller typically pays the state transfer tax called the grantors tax. Except as provided in this section a recordation tax on deeds of trust or mortgages is hereby imposed at a rate of 25 cents on every 100 or portion thereof of the amount of bonds or other obligations secured thereby. State and County Trust Tax 333 per 1000 of the new Deed of Trust loan amount.

The average rate for the benchmark 30-year fixed mortgage is 545 percent an increase of 3 basis points since the same time last week. Therefore no new deed transfer taxes are paid. The Commonwealth of Virginia levies a tax of 25 cents on every 100 on the amount refinanced Virginia Code 581-803 A.

Deed Tax 333 per thousand of the salespurchase price Trust Tax 333 per thousand of the loan amounts Grantors Tax 100 per thousand typically paid by seller Recording Fees approximately 100 total. For example if you spent 15000 on closing costs for a 15-year refinance youd deduct 1000 a year until your loan matures. Instead the recordation tax on a deed of trust given to refinance any existing debt will be according to set tiers starting at 018 per hundred on the first 10 million of value.

In Vermont the standard transfer tax for home buyers is 145 of the property value. Refinance State and County Trust Tax 333 per thousand of new Deed of Trust loan amount 833 per thousand PLUS 25 per thousand. 0 percent to 2 percent.

Transfer tax is calculated by purchase price Deed Tax 333 per 1000 of Purchase Price Trust Tax 333 per 1000 of loan amount. Original mortgage was for 500000 and the principle payoff is now 350000. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due.

Old Dominion Title Escrow 2425 Boulevard Ste 5 Colonial Heights VA 23834 804-526-8000. The grantors tax is divided equally between the state and the locality. 200 per 1000 is charged on new money difference of increase in loan amount if payoff lender and new originating lender are the same.

In the Northern Virginia region the Commonwealth levies an additional grantors tax of 015 per 100 or portion of 100 of the sales price or fair market value of the property excluding any liens or encumbrances. On a 15-year fixed refinance the annual percentage rate is 478. Im having trouble finding a source that conclusively says refinancing is subject to transfer tax in VA.

-The buyer is exempt from the state transfer tax if they are a first-time homebuyer in the state of Maryland. Remember that tax laws can change on a year-to-year basis. However you can claim this deduction every year until your loan matures.

Virginia Recordation tax aka. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000. Code 5131-803 D when a deed of trust is used in refinancing an existing debt with the same lender and the tax has been previously paid on the original deed of trust securing the debt the recordation tax will only apply to the portion of the deed of trust that exceeds the amount originally secured by the original debt.

Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. 2 hours agoTodays rate is higher than the 52-week low of 332. For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes.

Deeds of trust or mortgages. The cost is one percent or 1001000 of the transaction amount. The same rules apply for closing costs on a rental property refinance.

Therefore no new deed transfer taxes are paid. Last week it was. 200 per 1000 is charged on new money difference of increase in loan amount if payoff lender and new originating lender are the same.

Today the average 15-year fixed refinance rate is 467. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. The buyers half of the state transfer tax is waived if a first time buyer.

On any amount above 400000 you would have to pay the full 2. Im having trouble finding a source that conclusively says refinancing is subject to transfer tax in VA. North Carolina 1000.

Best Mortgage Refinance Companies Of 2022 Compare Refinance Rates U S News

Va Refinance How To Refinance A Conventional Mortgage To Va Loan

How Refinancing Works When A Home Have Equity Loan Co Hinh ảnh đầu Tư Kinh Tế Thị Trường Căn Hộ

Average Cost Of A Mortgage Refinance Closing Costs And Interest Charges Valuepenguin

How To Refinance A Mortgage With Bad Credit Money

Saving On Mortgage Taxes Mortgages The New York Times

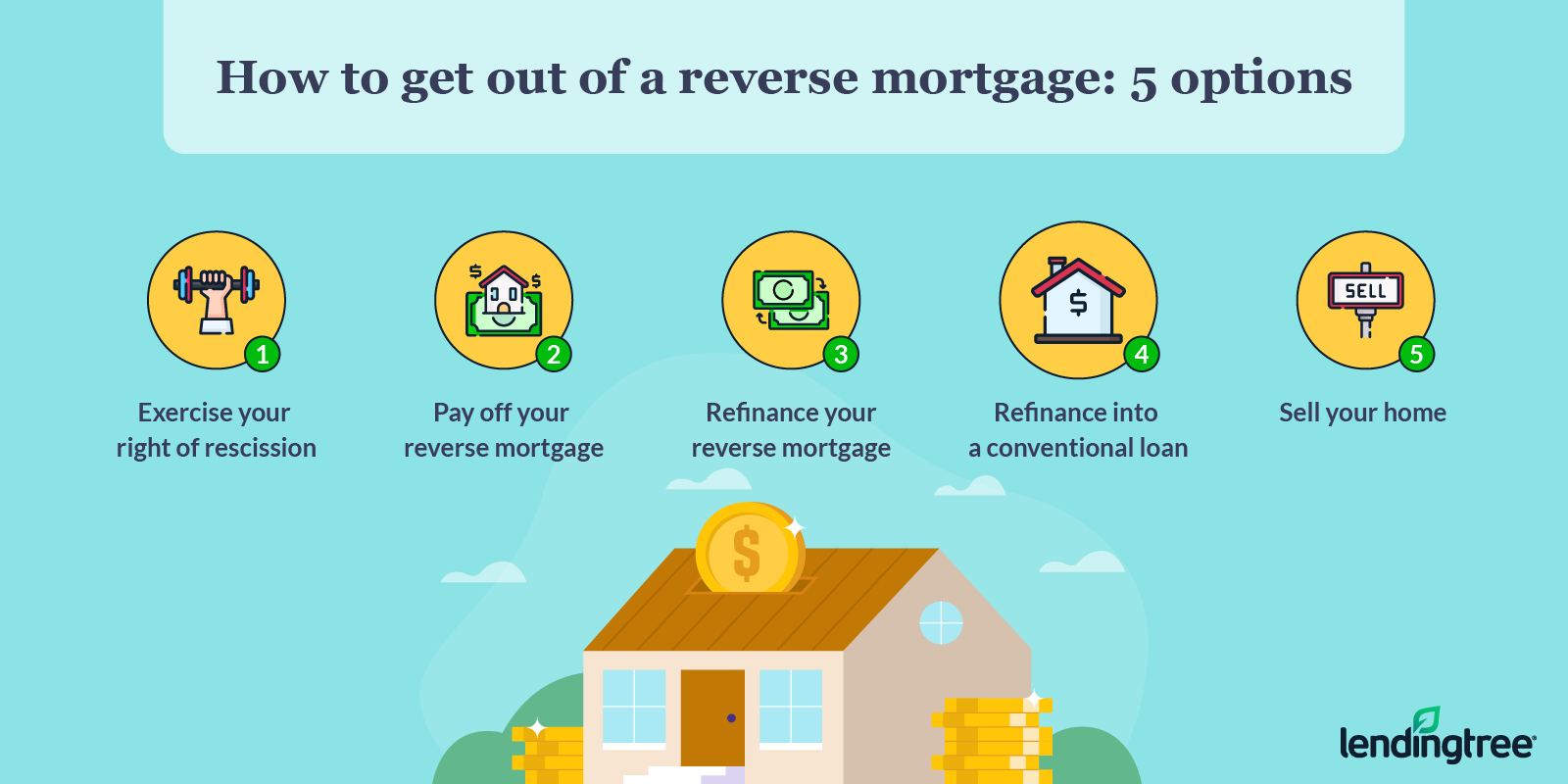

Can You Refinance A Reverse Mortgage Loan Home Com

What To Know About Refinancing A Mortgage In 2022 Money

Mortgage Refinance Get Today S Refinance Rates Ally

How To Refinance An Inherited Property Quicken Loans

Mortgage Refinance Calculator Estimate Savings Money

Cash Out Refinance Mortgage Refinance U S Bank

What To Know About Refinancing A Mortgage In 2022 Money

Fha Streamline Refinance Is It Right For You Smartasset

Beware Of This Common Mistake When Refinancing Your Home Snyder Law

Refinancing Your House How A Cema Mortgage Can Help

Best Refinance Lenders Of April 2022 Refinance Your Mortgage With The Best